ONEOK is a distributor of Natural Gas. Owning ONEOK allows me to get into the natural gas space without owning stock on the exploration side. I think of ONEOK as the FedEx or UPS of natural gas as it is the pipeline delivering product from point A to point B. I have wanted to get into natural gas pipeline stock, but honestly ONEOK has been overpriced until recently. Market downturns and an ongoing energy sector dip has created a good buying opportunity for this high dividend yielding stock.

I purchased 40 shares of ONEOK, Inc. (NYSE: OKE) at $38.53 totaling $1,941.56. My Investment Hunting portfolio is getting heavy on energy stocks. To date, about 16% of my portfolio is in oil and gas. I prefer to only have 10% of my portfolio targeted on one area so I will likely unload some oil stock on the next market gain. I own 100 shares of COP, so this stock is the likely candidate for a reduction in shares. This purchase adds $96.80 to my annual dividend income.

ONEOK Overview

ONEOK, Inc. is the sole general partner of ONEOK Partners, L.P. (ONEOK Partners), a master limited partnership engaged in the gathering, processing, storage and transportation of natural gas in the United States. The Company operates through three segments: Natural Gas Gathering and Processing, Natural Gas Liquids, and Natural Gas Pipelines. The Natural Gas Gathering and Processing segment provides nondiscretionary services to producers, including gathering and processing of natural gas produced from crude oil and natural gas wells. The Natural Gas Liquids segment owns and operates facilities that gather, fractionate, treat and distribute natural gas liquids (NGLs), and store NGL products, primarily in Oklahoma, Kansas, Texas, New Mexico and the Rocky Mountain region. The Natural Gas Pipelines segment owns and operates regulated natural gas transmission pipelines and natural gas storage facilities.

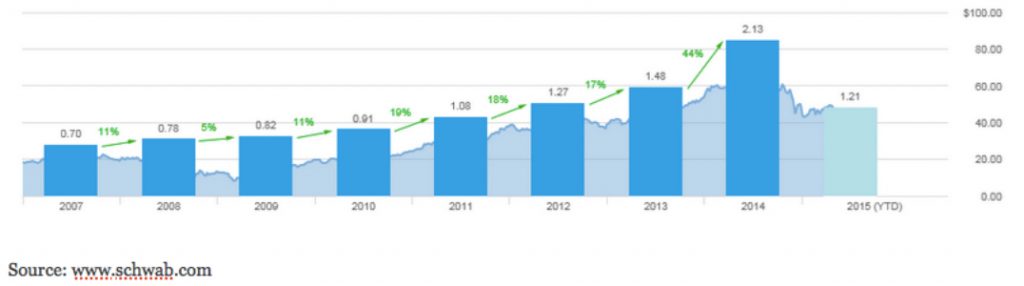

Source: www.schwab.com.

ONEOK Dividends

- Annual Dividend Yield of 6.38%

- 5-Year Dividend Per Share Average of $1.37

- 5-Year Dividend Yield Average of 2.96%

- 3- Year Dividend Growth Rate of 25.3%

- 5- Year Dividend Growth Rate of 21%

- 10- Year Dividend Growth Rate of 17.1%

- Payout Ratio of 59.38%

- Dividend Coverage Ratio (TTM) of 168.42%

The chart below shows the past eight years of annual dividends for OKE. This chart visually represents how impressive dividend raises have been for ONEOK. OKE has an impressive a 5-year dividend growth rate average of 21%.

ONEOK Valuation

S&P Capital IQ ranks OKE as a hold and 3-stars with a 12-month target price of $48.

Morningstar ranks OKE as a buy, 4 stars with a fair value of $52.

Using my dividend toolkit I used the dividend discount model analysis with the following metrics: 9% Discount Rate and an 5% Dividend Growth Rate. I get a fair value of $63.53.

Conclusion

I like owning distribution stocks because they own the pipeline for delivery. This is sort of a Monopoly; if a seller wants to move goods they need a distributor. There is safety in OKE because of this, however this stock is still subject to natural gas pricing. I don’t see gas usage declining in the near future so I am comfortable with my purchase. Also natural gas prices are low, which means there is a lot of upside if prices recover. I’m not the only dividend investor who thinks ONEOK is a good investment. Below are links to a few ONEOK stock buy posts from dividend blogging community:

Dividend Mantra

Frugality To Financial Freedom

Passive Income Mavericks

What do you think of the ONEOK? Are you buying energy stocks now or waiting for a recovery?

Full Disclosure: Long OKE